What life might look like post Covid-19

- By Peter Gordon

- •

- 02 Apr, 2020

While it may be hard to see the bright side of crisis that is affecting us all, the following article by Bernard Salt (Director of The Demographics Group ), gives some great insights into what life might look like post Covid-19. It's definitely worth the read.

The question that everyone, including those in the property industry, really wants answered is simple: is Australia a good place to invest beyond the carnage that is being wreaked upon the accumulators and the creators of wealth, namely the investors and the businesses that demand property services?

Let’s look at how Australia fares in the years following a global catastrophe.

The only truly comparable precedents (in modern times) to the current pandemic are the two world wars (1914-18 and 1939-45), the Spanish flu epidemic (1918-20) and the Depression (1929-32). High-impact events such as 9/11 (2001) and the global financial crisis (2008) also have been important in shaping our modern world.

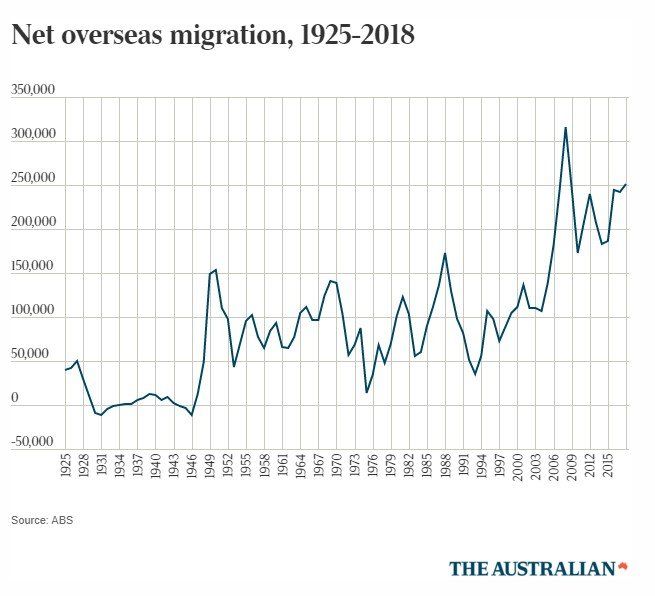

Over the 100 years during which these catastrophes have played out, Australia’s population has increased from six million to 26 million, largely because of net overseas migration.

Following the horror of World War I and the subsequent Spanish flu epidemic, distant, “safe”, English-speaking Australia attracted 50,000 migrants a year to a nation one-fifth the size it is today. In the post-apocalyptic world of 1920s Europe, Australia was very much seen as the escape option.

The Depression and World War II coalesced to create a two-decade world of pain for the British and southern Europeans who again saw Australia as a safe destination. Immigration levels topped 150,000 in the 50s when Australia was a third the size it is today.

Large inflows of people have the effect of immediately boosting employment, spending power and the demand for housing and commercial property. The great challenge for the nation is to manage the big issues associated with large-scale migration, namely retaining and building social cohesion and the provision of infrastructure.

But there are bigger implications for the property industry from a global catastrophe than a mere consequential boost to Australia’s population and demand for housing. Calamitous times unleash spending, change behaviours, and create systems and technologies and businesses that then go on to help rebuild the nation and the economy after the carnage.

Australia’s Commonwealth Serum Laboratory (now CSL) was formed during the Spanish flu epidemic. Woolworths was founded in Sydney during the Roaring Twenties.

Dutch immigrant Dick Dusseldorp founded Lend Lease (as Civil & Civic) in 1958 amid the sunny optimism of an expanding Australia. Another post-war immigrant, Frank Lowy, created Westfield in Sydney in the early 60s.

The point I am making is that large-scale events, including war and pandemics, have the effect of galvanising human behaviour and reshaping the immediate future.

The planning of the D-Day invasion prompted a way of thinking that later found its way into the corporate world. Confidential projects in the financial services industry (and perhaps elsewhere) are codenamed in the same way the Normandy beaches were codenamed Omaha, Utah, Juno, Gold and Sword. The learnings from war are transposed into peacetime operations.

From an Australian perspective, the GFC triggered a three-year boom within the long boom that followed our last recession, in 1992. China ramped up demand for Australian resources. The years 2008 to 2012 were, in fact, some of Australia’s most prosperous times.

Perhaps more so than any previous catastrophe, the coronavirus outbreak is globally encompassing. No one and no country is immune. The virus is entirely ecumenical in that it affects the rich as well as the poor.

There is no hiding. This event will reshape consumer behaviour; it will unleash government and corporate spending; and it will prompt heightened demand for post-pandemic migration to the “safe haven” of Australia.

In a post-pandemic world, Australia surely will review its critical infrastructure planning. Manufacturing will be reinvigorated. Supply chains, manufacturing plant, agribusiness, health and medical research facilities will be supported. There could even be a renewed commitment by the US to increase its presence in Asia via Australia, especially Darwin.

In the post-pandemic world, the decade of the 2020s morphs into an era of renewal and rebuilding. Businesses lost during the carnage resurface or are replaced by leaner, more targeted, more automated, more digitally connected and far more cautious enterprises with far stronger balance sheets.

When the pandemic finally passes, Australia and other nations will emerge tentatively from the mire. The time to be a chief executive isn’t so much now — dealing with the stress and the strain of cutbacks and survival — but from next year onwards during the glorious rebuilding of the irrepressible Australian economy.

As infrastructure comes online, as businesses re-engage workers, as consumers breathe a palpable sigh of relief that the lockdowns are over, spending will recover. In some ways, the best career positioning at the moment is probably to be a chief financial officer aged mid to late 30s with the requisite skills and the optimistic world view to convince a board that they are ready to take the reins early next year.

If the GFC was the last hurrah of the baby boomers in executive roles, maybe the pandemic is the beginning of the end for executive Xer leaders. In the past decade, boomers moved to boards; in the 2020s, it’ll be Xers moving into board positions.

The 1920s was a period of optimism, especially in hard-hit cities such as Berlin and Paris. This idea of “relief optimism” was evident in these cities in dance (for example, the Charleston) and in cabaret. When people are happy and relieved, they show it. They sing it to the world.

And, again after World War II, the 50s was an era of rising prosperity and of a uniquely sunny optimism that is perhaps best captured by the examples of Disneyland and McDonald’s, which started at this time.

And so, regardless of whatever pain and sacrifice and hardship may lie ahead for all of us, the evidence from recent history is that humanity always seeks to rebuild. And in that rebuilding Australia, remote and cut off from the world by the tyranny of distance, is then viewed warmly as a place of refuge, as a place of prosperity, that is hygienically managed.

In this most terrible of global catastrophes, the better Australia performs in terms of infections and deaths in blunt comparison with other nations, the more attractive it will appear to business and skilled (and ambitious) migrants during the 2020s.

In this coming decade, there will be new versions of Lowy and Dusseldorp, there will be new businesses that encapsulate the times like McDonald’s and Disneyland, there may even be new businesses that flow out of survivalist government spending of the kind that spawned CSL all those years ago.

It is dangerous to think that all we need to do as a nation is hunker down and wait until the storm passes. We need to be thinking now about how the world we emerge into has changed. Not so much because of the havoc wreaked by the raging storm but by the way we have changed as a people.

The longer the lockdown, the more lethal the pandemic, the more frightened we are, the greater will be the human response.

The best thing a board can do is to scope not the new world that we think will greet us but to plan now for the kind of business and world we want to build for the future.

Article appeared in The Australian by Bernard Salt (managing director of The Demographics Group) 26th March 2020.

If you are concerned about the ever changing landscape and are unsure of what to do please reach out for assistance.

The Team at Investo Property are here to help.

CONTACT ME NOW peter@investoproperty.com.au

| Quiet simply, the Palms is the place to buy! |

Sydneysiders and Melburnians, put aside your equally outstanding flat whites for a moment. Stop bickering about whether great beaches beat cool laneways (they do) and desist from debating whether all baristas require waxed moustaches (ideally).

Because Brisbane is closing in on the title of Australia’s best city, and we must join forces to keep this subtropical upstart in its place.

Time magazine recently named Brisvegas on its “World’s Greatest Places” list, and omitted our cities. It’s a huge shock (and who knew they still published Time magazine?). But they might be onto something.

Time points to the 2032 Olympic and Paralympic Games, which will be hosted in the maroon metropolis. Brisbane will do a fine job, even though it’ll baffle the world when rugby league is added to the schedule and Queensland is allowed to field its own team.

Time’s most radical claim is that Brisbane is worth visiting now, but tourism is surging. Not only did Lin-Manuel Miranda recently drop in to catch Hamilton , but hundreds of Hamilfans flew up to watch his interview with Leigh Sales (presumably unaware that it would subsequently arrive on iView for free).

A leading local agent has appraised each side of these duplex's to be worth $665k on completion and rent for $495 per week. So that is massive potentail instant equity of up to $390K on completion, which is incredibly hard to find.