Suburbs Where Property Prices Have Trebled

- By Peter Gordon

- •

- 17 Jun, 2019

Despite home prices declining in Australia's two biggest cities over the last 18 months, historical data has revealed that median house prices in 111 Australian locations have trebled or better over the past 20 years. This is a great article on property prices in Australia at present. We've always been a fan of regional cities, providing they tick all the boxes ie. infrastructure spending, employment precincts, healthcare, education and transport and accessibility to major cities.

Following the surprise re-election of a Coalition government, APRA's proposal to scrap the 7 per cent mortgage serviceability rate required of borrowers and the first rate cut since August 2016, there has been a noticeable change in sentiment in the last month across the property industry and markets.

Property vendors during the downturn have been gripped with FONGO (fear of not getting out), moving to offload their properties before prices fell even further, replacing the FOMO (fear of missing out) for buyers that had driven values upwards over the years.

Longstanding property owners in some of Australia's toughest property markets, who have been lucky enough to avoid purchasing at the top of a cycle, have potentially experienced continued growth.

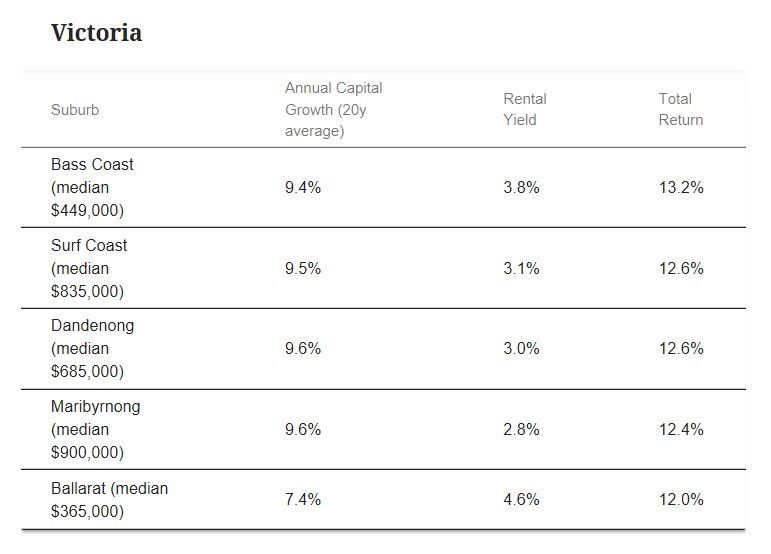

New analysis from research firm Propertyology has plotted two decades of property price movements with several years of very strong gains staring around 2012 pushing property prices and propelling homeowners in a number of Australian suburbs.

Analysts observed more than 180 Australian towns and cities, with a population of 10,000 people or more, over the 20-years ending December 2018.

“Whether someone purchased real estate in any of our eight capital cities twenty years ago or in a majority of Australia’s non-capital locations, today it’s worth at least three times what you paid for it,” Propertyology head of research Simon Pressley said.

“I don’t know about anyone else, but an average annual capital growth rate of circa six per cent across 20 years sounds damn good to me, especially at a time when Australia’s two largest cities have dropped 10 per cent in value in the past 12 months.”

Analysts found that median house price of 103 regional cities and towns trebled in price over the past 20 years. “The research clearly shows that regional real estate has just as much potential as capital cities, which is why smart investors make an objective assessment of every location in Australia before buying.”

According to Propertyology, Australia’s most expensive city to purchase a house is now Byron Bay in northern New South Wales, with its median house price increasing by a whopping 64 per cent over the past five calendar years.

A recent nationwide analysis showed the median Byron house price was more than $987,500, putting it ahead of Sydney, at $950,000, while Melbourne ranks sixth at about $772,000.

“Generally speaking, locations with a more affordable median house price have more upside potential for capital growth. For that potential to be realised, the real skill is being able to identify the locations with positive leading economic indicators,” Pressley said.

*

We still believe there are opportunities in regional area,s and at the moment we are loving Ballina for affordable house & land packages in an Estate that has elevated views, breathtaking landscape of rolling hills and natural waterways. Ballarat also has full turn key 4 bedroom H & L packages available.

If it's more apartments you're looking to invest in we have one, two and three bedroom apartments some with breathtaking views of the harbour and Newcastle CBD.

The Gold Coast & Sunshine coast is also on our radar for apartments with endless views stretch out in front of you in prestigious coastal locations. Both of these developments offer resort style amenity along with designer kitchens and well designed, luxurious living spaces.

If you'd like to meet for a one on one chat with Peter to find out more about the above properties please contact the Investo Team

*Article courtesy Property Observer 14th June 2019

| Quiet simply, the Palms is the place to buy! |

Sydneysiders and Melburnians, put aside your equally outstanding flat whites for a moment. Stop bickering about whether great beaches beat cool laneways (they do) and desist from debating whether all baristas require waxed moustaches (ideally).

Because Brisbane is closing in on the title of Australia’s best city, and we must join forces to keep this subtropical upstart in its place.

Time magazine recently named Brisvegas on its “World’s Greatest Places” list, and omitted our cities. It’s a huge shock (and who knew they still published Time magazine?). But they might be onto something.

Time points to the 2032 Olympic and Paralympic Games, which will be hosted in the maroon metropolis. Brisbane will do a fine job, even though it’ll baffle the world when rugby league is added to the schedule and Queensland is allowed to field its own team.

Time’s most radical claim is that Brisbane is worth visiting now, but tourism is surging. Not only did Lin-Manuel Miranda recently drop in to catch Hamilton , but hundreds of Hamilfans flew up to watch his interview with Leigh Sales (presumably unaware that it would subsequently arrive on iView for free).

A leading local agent has appraised each side of these duplex's to be worth $665k on completion and rent for $495 per week. So that is massive potentail instant equity of up to $390K on completion, which is incredibly hard to find.