Property Investors Rise in Every State and Territory

- By Peter Gordon

- •

- 21 Oct, 2019

Consecutive rate cuts combined with an easing in lending standards has seen a sharp rise in investor lending with every state and territory recording a lift in the value of investment loans.

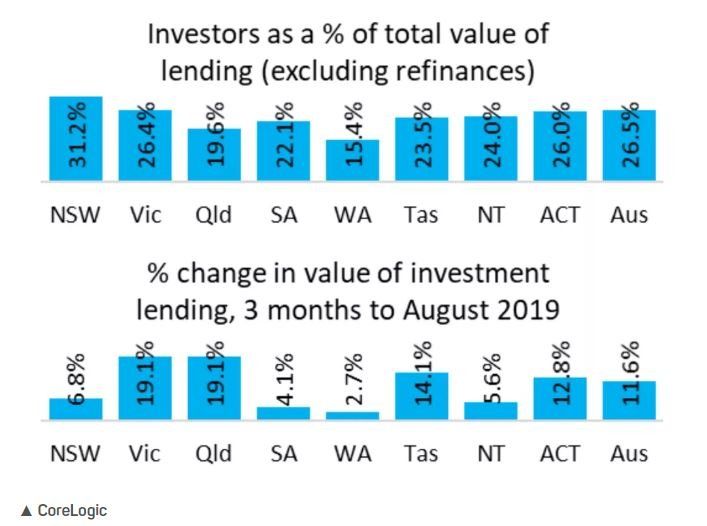

Victoria and Queensland recorded the largest rise for the three month period to August, where the value of investment home loan commitments increased by 19.1 per cent, according to Corelogic.

But proportionally, investment activity is concentrated in New South Wales where investors make up 31.2 per cent of mortgage demand based on the value of loan commitments, excluding refinances.

Victoria follows, at 26.4 per cent and Canberra at 26 per cent.

Western Australia, where housing values have declined since 2014, shows the lowest share of investors at 15.4 per cent.

Corelogic's Tim Lawless said the housing market had “turned a corner” with values rising across five of the eight capital cities over the September quarter, an attraction for investors eying capital gain opportunities.

“The value of home loans committed to by investors has recorded a sharp rise since June,” Lawless said.

“Rising a cumulative 11.6 per cent over the three months ending August, the fastest rate of growth in the value of investment loan commitments since November 2016.”

In his latest update, Reserve Bank deputy governor Guy Debell noted that investor demand had notably slowed during the recent property slow down, but that in his view it was primarily a decrease in investor demand given falling housing prices, more than the impact of tighter lending conditions.

Moving forward, Lawless says there’s a “strong likelihood” investor activity might increase further.

“The long term average shows investors are typically around one-third of mortgage demand, implying investors are currently under-represented in the market.

“As investment activity rises we could see increased price pressures as this sector of the market tends to be more competitive in setting new price benchmarks.”

Article courtesy The Urban Developer 17/10/19

If you'd like to find out more about the opportunities we have available please contact the Investo Team

| Quiet simply, the Palms is the place to buy! |

Sydneysiders and Melburnians, put aside your equally outstanding flat whites for a moment. Stop bickering about whether great beaches beat cool laneways (they do) and desist from debating whether all baristas require waxed moustaches (ideally).

Because Brisbane is closing in on the title of Australia’s best city, and we must join forces to keep this subtropical upstart in its place.

Time magazine recently named Brisvegas on its “World’s Greatest Places” list, and omitted our cities. It’s a huge shock (and who knew they still published Time magazine?). But they might be onto something.

Time points to the 2032 Olympic and Paralympic Games, which will be hosted in the maroon metropolis. Brisbane will do a fine job, even though it’ll baffle the world when rugby league is added to the schedule and Queensland is allowed to field its own team.

Time’s most radical claim is that Brisbane is worth visiting now, but tourism is surging. Not only did Lin-Manuel Miranda recently drop in to catch Hamilton , but hundreds of Hamilfans flew up to watch his interview with Leigh Sales (presumably unaware that it would subsequently arrive on iView for free).

A leading local agent has appraised each side of these duplex's to be worth $665k on completion and rent for $495 per week. So that is massive potentail instant equity of up to $390K on completion, which is incredibly hard to find.