Doomsday house price forecasts are highly questionable

- By Peter Gordon

- •

- 21 May, 2020

Great article from the president of the Real Estate Institute of Australia, addressing some of the hype around at the moment about the property market. It's worth the read for anyone who owns property or is thinking about buying property.

The REIA says that forecasts of housing price drops of as much as 30% are highly questionable and cannot be relied upon with any degree of confidence.

We are in unprecedented times and anyone that suggests they can forecast with any acceptable degree of probability is being highly fanciful.

We can only look at what is happening in the market place at the moment as well as in previous times of high unemployment to provide pointers to likely outcomes.

Currently we have a situation where listings are decreasing yet the enquiry level from prospective buyers is increasing. It is simple economics that when supply decreases and demand remains that prices edge upwards. They certainly don’t drop.

Recent forecasts suggest that the supply of new housing will be severely constrained over the coming year. The Housing Industry Association is expecting building of new dwellings to fall by almost 50 per cent over the rest of 2020 and into 2021.This does not suggest a scenario of supply exceeding demand – a prerequisite for falling prices.

Whilst it is expected that higher levels of unemployment will provide a constraint on house prices the anticipated levels of around 10% have been experienced before and we should look at what happened to housing prices then.

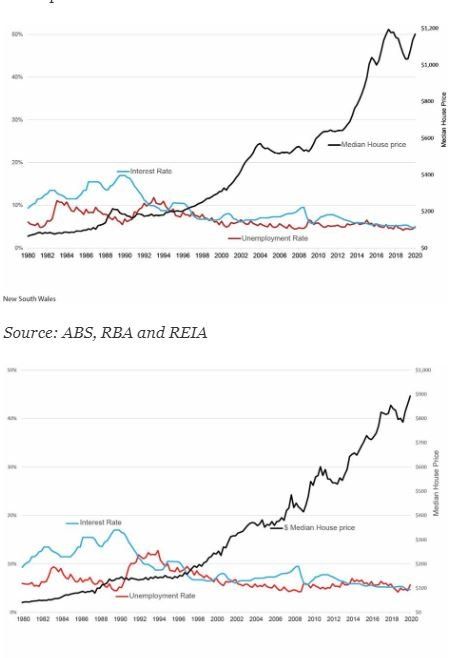

Graphs 1 and 2 show median housing prices, interest rates and unemployment rates for the period from 1980 for News South Wales and Victoria – Australia’s two largest housing markets.

History shows us that in the early 1990s we had a sustained period of unemployment above 10% yet median house prices remained stable.

It needs also to be remembered that in ‘the recession we had to have’ interest rates for housing loans were around double what they currently are.

I do not believe that this points to a catastrophic outlook for house prices.

Article courtesy - ADRIAN KELLY - President of the Real Estate Institute of Australia

schedule a Zoom Meeting here

| Quiet simply, the Palms is the place to buy! |

Sydneysiders and Melburnians, put aside your equally outstanding flat whites for a moment. Stop bickering about whether great beaches beat cool laneways (they do) and desist from debating whether all baristas require waxed moustaches (ideally).

Because Brisbane is closing in on the title of Australia’s best city, and we must join forces to keep this subtropical upstart in its place.

Time magazine recently named Brisvegas on its “World’s Greatest Places” list, and omitted our cities. It’s a huge shock (and who knew they still published Time magazine?). But they might be onto something.

Time points to the 2032 Olympic and Paralympic Games, which will be hosted in the maroon metropolis. Brisbane will do a fine job, even though it’ll baffle the world when rugby league is added to the schedule and Queensland is allowed to field its own team.

Time’s most radical claim is that Brisbane is worth visiting now, but tourism is surging. Not only did Lin-Manuel Miranda recently drop in to catch Hamilton , but hundreds of Hamilfans flew up to watch his interview with Leigh Sales (presumably unaware that it would subsequently arrive on iView for free).

A leading local agent has appraised each side of these duplex's to be worth $665k on completion and rent for $495 per week. So that is massive potentail instant equity of up to $390K on completion, which is incredibly hard to find.