The below is a great article on the Brisbane property market, it's very detailed but well worth the read.

The Urban Developer’s Brisbane housing market insights for May reveals increased demand for houses and approvals for new units has been underpinned by increasing consumer sentiment and a surge in interstate migration.

This resource, to be updated monthly, will collate and examine the economic levers pushing and pulling Brisbane’s housing market.

Combining market research, rolling indices and expert market opinion, this evolving hub will act as a pulse check for those wanting to take a closer look at the movements across the market.

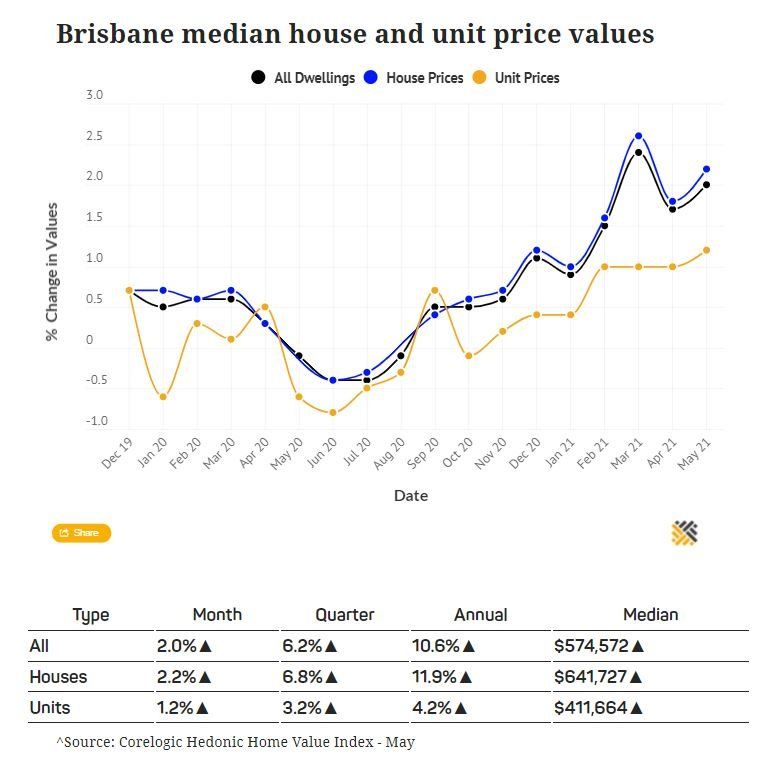

Brisbane continues to be the capital city that provides buyers and investors with “most bang for buck” for both houses and units.

The number of buyers searching for homes in the $1 million price point in Brisbane has gone up 30 per cent in the last three years, from 20 per cent of all buyers in 2019, to 26 per cent today.

By comparison, the number of buyers searching for homes around $500,000 has tanked by 43.3 per cent, and those shopping around $750,000 has fallen 16.6 per cent.

Median house values across Brisbane range from $380,000 (Archerfield) to $2 million (Teneriffe), with the median house value in the Brisbane local government area now $754,500.

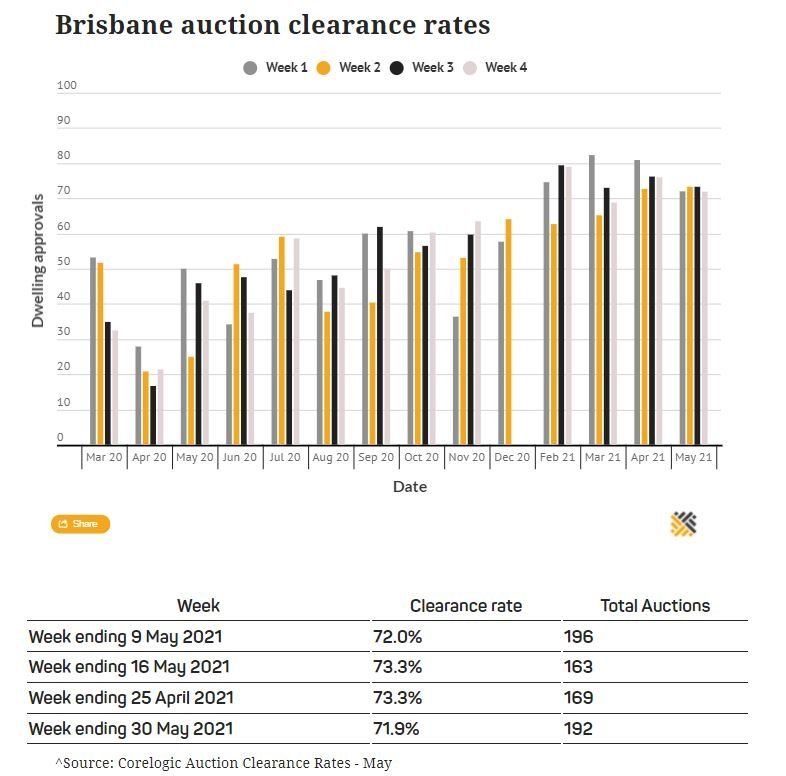

New listings (less than 30 days old) in Brisbane slowed across May falling by 7.1 per cent with the downward trend in old listings suggesting strong absorption rates.

The proportion of Brisbane sellers bumping up their asking price mid-campaign continues to tail off from peak levels reached late last year.

Vendors in the premium suburbs of Brisbane were the most bullish, indicating the upper end of the market will continue to lead price growth in the coming months.

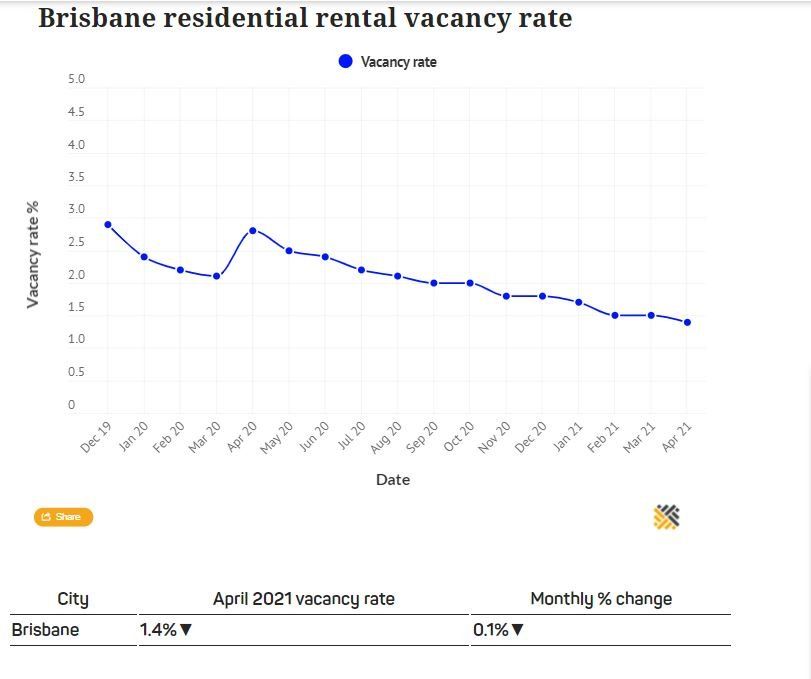

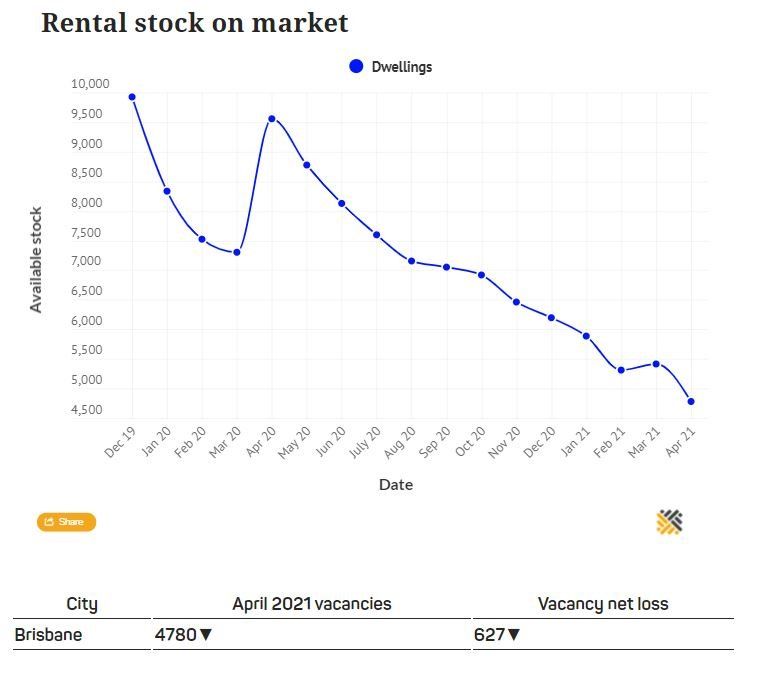

Vacancy rates have fallen further in Brisbane, putting increased pressure on asking rents.

The biggest drops in rental vacancies and listings were concentrated in the CBD and around universities.

Traditionally in Brisbane, vacancy rates have been tight; hovering well below the level of 2.5 per cent vacancies, which traditionally represents a balanced rental market.

However, record-low rates, government support, and stimulus measures, and the pandemic-driven rush north by residents of Melbourne and Sydney has powered the recovery in Brisbane’s rental market, driving the rate down to a near nine-year low.

Brisbane’s rental vacancy rate fell to 1.4 per cent in April from 1.7 per cent in January and was well down from 2.2 per cent a year earlier, according to SQM Research.

Detached building approvals reached a record level for the third consecutive month in April 2021.

Detached housing approvals increased by 14.8 per cent in the three months to April 2021, to be 63.7 per cent higher than the same time last year.

Although new home sales fell in April, the results suggest that a significant number of new homes are still entering the construction pipeline for customers post HomeBuilder.

Low interest rates, strong house price growth and an increased preference for detached homes and regional areas will continue to drive demand for new houses over the months to come.

In seasonally adjusted terms, detached approvals saw the biggest increase in the three months to April 2021 compared to the same time last year in Queensland, up 65.7 per cent.

According to the Australian Bureau of Statistics, residential construction surged by 10.2 per cent in Queensland across the March quarter.

New data from the ABS and APRA have provided updated insights into the housing lending space, which is highly correlated with trends in home prices and sales volumes.

Lending for the purchase of property hit record highs through April 2021.

Across Queensland, the number of loans to owner-occupiers for the construction of a new dwelling in the three months to April 2021 compared to the same time last year more than doubled in to be up 145 per cent.

However, the concentration of mortgages regarded as “higher risk” remained around average levels through the start of the year.

As new lending continues to rise, ABS housing lending indicators have pointed to a continued shift in the profile of the buyer, with first home buyer lending falling for a third straight month against a rise in other types of secured finance.

While the investor segment saw the fastest increase in the value of finance, owner-occupier buyers who were not first home buyers (such as up-sizers, movers and down-sizers) maintained the most dominant share of housing finance for the purchase of property by value.

Brisbane’s population grew by 1.9 per cent during 2019-20, recording the highest growth rate of all capital cities, according to Australian Bureau of Statistics data.

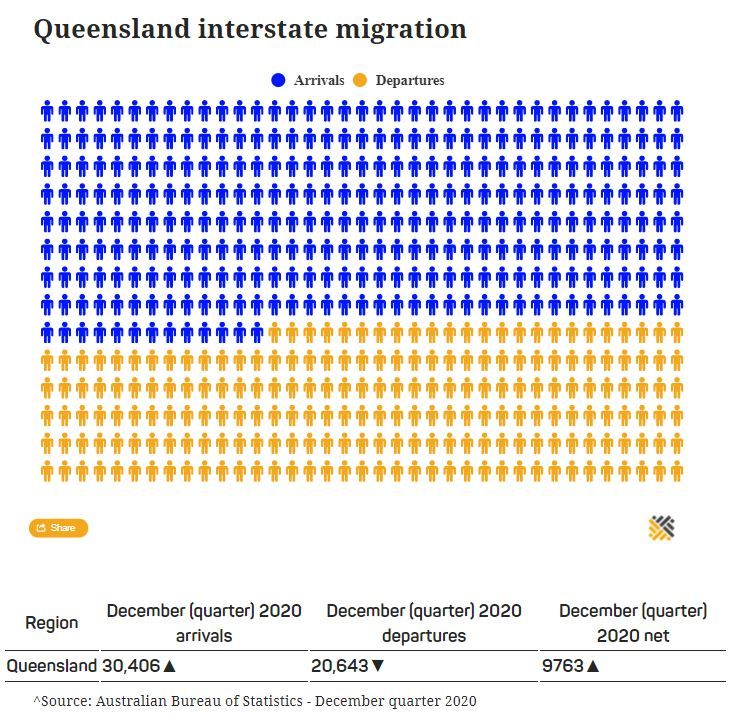

Queensland experienced its biggest boom in new residents in almost two decades the December quarter of 2020, with a net gain of 30,000 people from interstate.

Queensland’s population is expected to surge by more than a quarter of a million people in the next four years according to forecasts in the federal budget, as people flood in from other states.

Treasury boffins have predicted Queensland is set to gain around 20,000 people from interstate each year for the next four years—amounting to almost 85,000 new residents by mid-2025.

Next year alone, federal treasury estimates see Queensland gaining 23,800 new interstate residents, while Victoria is set to lose 1200 and New South Wales is tipped to shed as many as 15,500.

Queensland’s population is predicted to hit 5.44 million by mid-2025, up from 5.17 million in June 2020.

Article courtesy The Urban Developer 11/7/21

If you're considering investing in property we're here to help! We haver many options available and believe now is the right time to invest. Let us assist you and show you opportunities that are available, check out our property page or

contact me for a Zoom meeting.

schedule a Zoom Meeting here